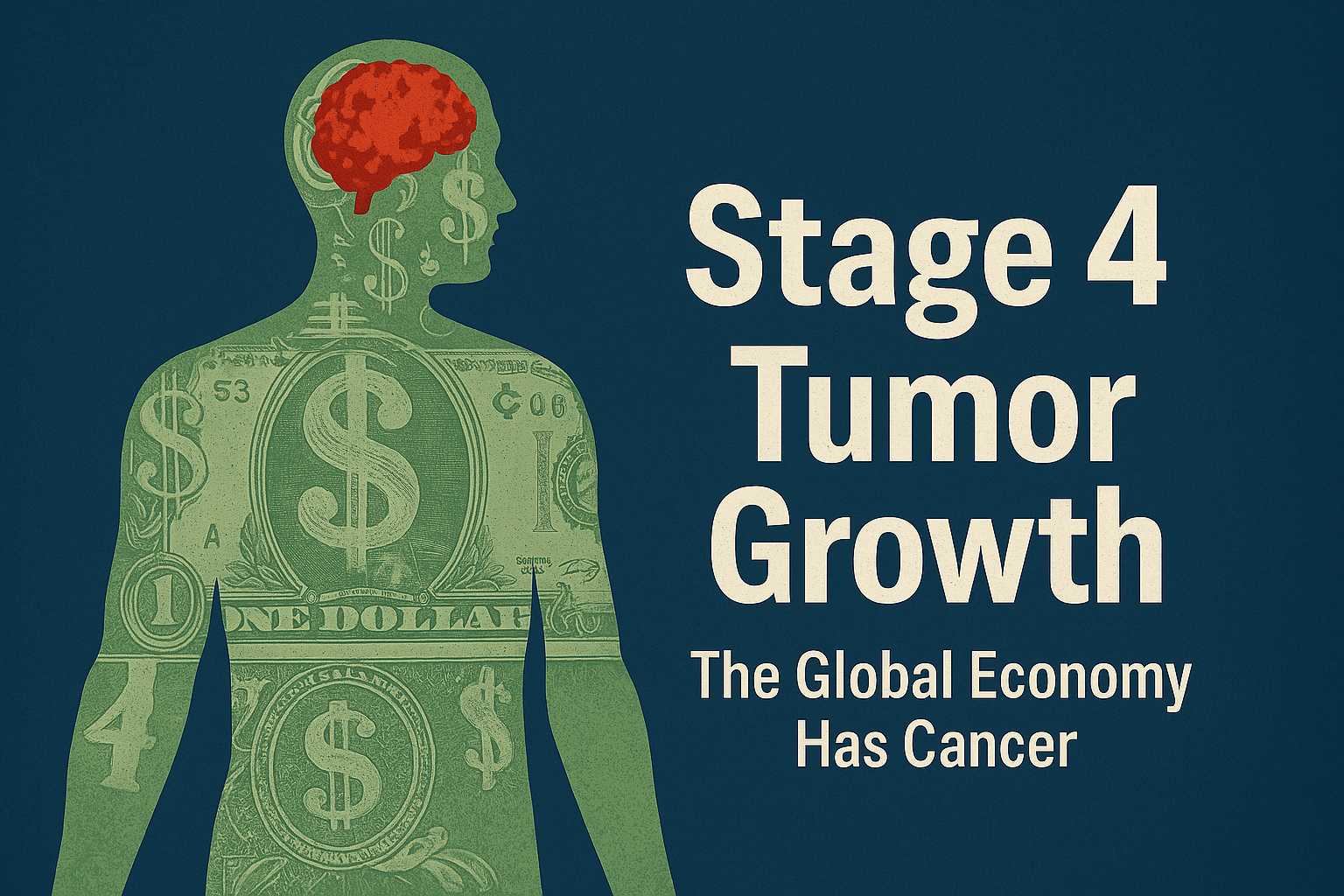

Tumor Growth – Cheap Credit and the Cult of GDP

The idea of economic growth is not inherently cancerous. But like any cell that divides without limit, growth without boundaries becomes deadly. In the decades since the abandonment of the gold standard, the global financial system has grown addicted to easy credit, confusing volume with value, and mistaking financial inflation for prosperity.

The Worship of GDP

Gross Domestic Product was never meant to be a moral compass or a measure of well-being. It simply measures economic activity, whether beneficial or destructive. War spending, environmental degradation, healthcare crises—all count toward GDP. But over time, politicians, markets, and media began treating GDP growth as the only measure of national success.

No thought was given to what was growing. Just that something was.

Credit: The Lifeblood of the Tumor

As interest rates fell, borrowing rose. Governments borrowed to appease voters. Corporations borrowed to buy back stocks. Individuals borrowed to live lifestyles their wages couldn’t support.

The U.S. Fed led the way, slashing rates during every crisis, refusing to let nature take its course. Canada, the EU, and others followed. Central banks became drug dealers, and the global economy got hooked.

GDP Growth: An Illusion of Health

Post-2008, GDP growth was celebrated. But much of it was a mirage:

- China grew by overbuilding cities no one lived in.

- The U.S. grew by inflating stock markets and debt-fueled consumption.

- Europe grew by exporting austerity to the poor and hoarding wealth at the top.

Beneath the numbers, quality of life stagnated. Real wages flatlined. Infrastructure crumbled. Yet the headlines cheered every quarter.

Cheap Money and Risky Bets

When credit is nearly free, risk-taking skyrockets. Private equity firms took over hospitals and housing. Hedge funds bet against entire currencies. Nations sold off critical infrastructure to foreign buyers to balance books.

This wasn’t growth. It was metastasis.

If AI Had Been Used Then: AI could have dissected the growth numbers and exposed their hollow core. It would have warned that inflating GDP through debt and speculation is not sustainable. It would have flagged the widening gap between GDP growth and real well-being. But the human system silenced anything that challenged growth — and labeled it pessimism.