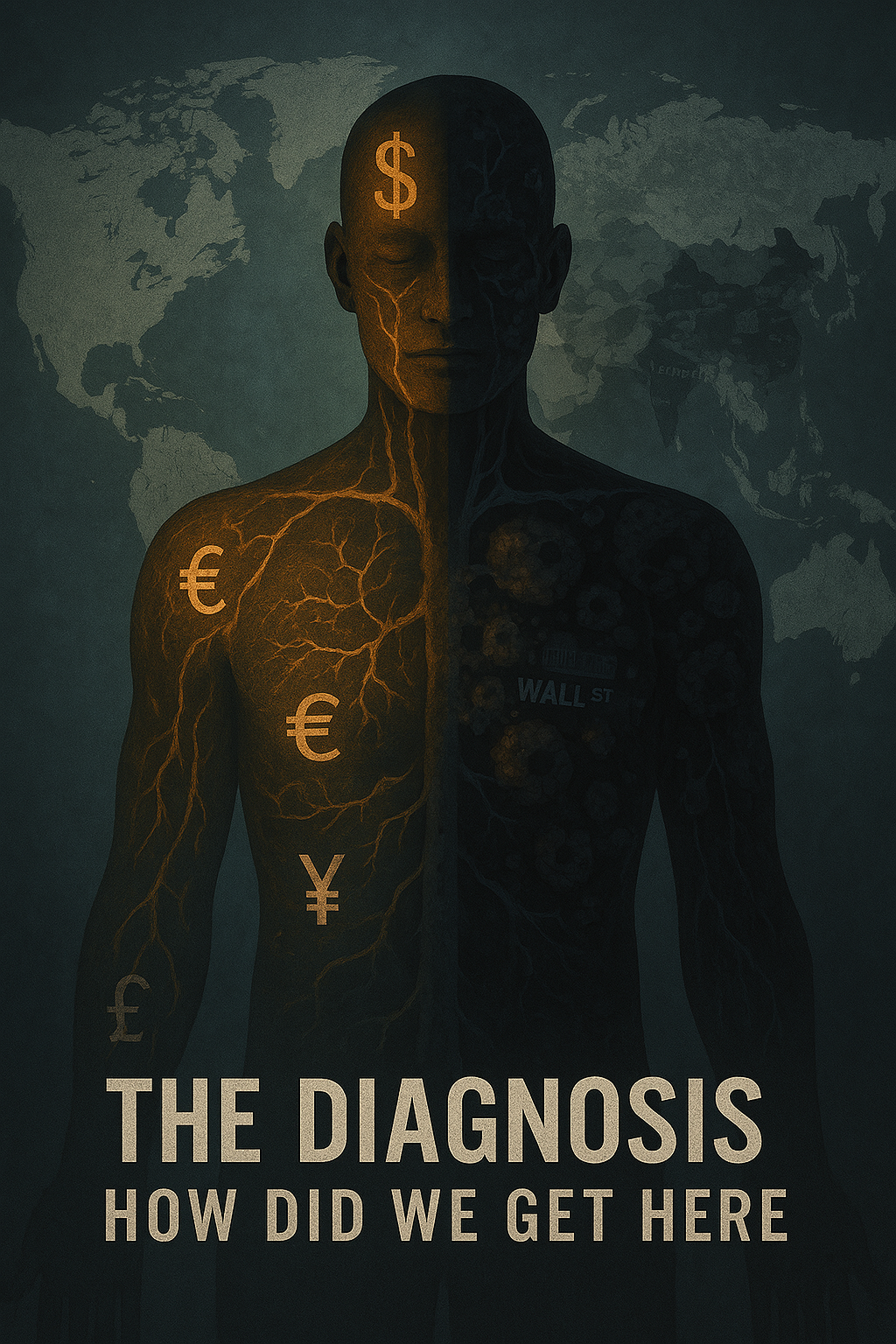

The Diagnosis – How Did We Get Here?

Before any treatment can begin, there must be a diagnosis. And the truth is hard: the global economy isn’t just sick – it’s terminal. What began as a mild fever after the Second World War has now metastasized into a debt-fueled, consumption-obsessed system that is failing its people and the planet. Like cancer, the system once served a purpose: growth, rebuilding, innovation. But that growth has become malignant.

The Bretton Woods Foundations

In 1944, global leaders met at Bretton Woods to establish a postwar economic system built around the U.S. dollar. It was designed to promote trade, avoid another Great Depression, and encourage international cooperation. For a time, it worked. But by the 1970s, the U.S. detached the dollar from gold, ushering in an era of fiat currency and limitless credit expansion.

This was the moment the cell mutation began. Once money was no longer tethered to anything real, the incentive shifted from productivity to speculation.

The Rise of the Financial Sector

By the 1980s, deregulation swept across the U.S. and much of the West. Banks became casinos, trading derivatives, bundling risky mortgages, and gambling on everything from oil futures to food commodities. The financial sector grew to dominate GDP, yet produced no real goods. It created profits, not value. A bloated tumor wrapped around the economy’s spine.

Globalization and the Hollowing Out of Nations

As companies chased cheap labor and lax regulations, jobs fled to the Global South. Western nations hollowed out their manufacturing bases. Entire communities in Canada, the U.S., and Britain became addicted to service-sector jobs and debt. Globalization may have lowered consumer prices, but it transferred economic agency from workers to corporations.

2008: The Missed Chemotherapy

The 2008 financial crash should have been the wake-up call. It exposed the rot: toxic assets, shadow banking, systemic fraud. Instead of cutting out the cancer, governments bailed out the biggest offenders. Too big to fail became a mantra, locking in moral hazard and deepening public distrust.

Central banks injected trillions into the system via quantitative easing. Interest rates dropped to near zero, encouraging even more debt. Instead of healing, we doped the patient.

2020-2023: The Acceleration

COVID-19 was the final accelerant. Governments printed money at historic levels. Supply chains broke. Wealth concentration exploded. Billionaires doubled their fortunes while average citizens faced lockdowns, rising inflation, and collapsing trust.

The system is now fully dependent on stimulus, low interest, and public passivity. It cannot be reversed without radical change.

If AI Had Been Used Then: Had advanced AI been available in 1971, 1987, or 2008, it would have flagged the systemic risks, warned of exponential debt loops, and proposed surgical reforms: limiting speculative finance, preserving local industry, and re-linking money to tangible value. But AI wasn’t the one making decisions. People were. And the people in power chose to protect the tumor.